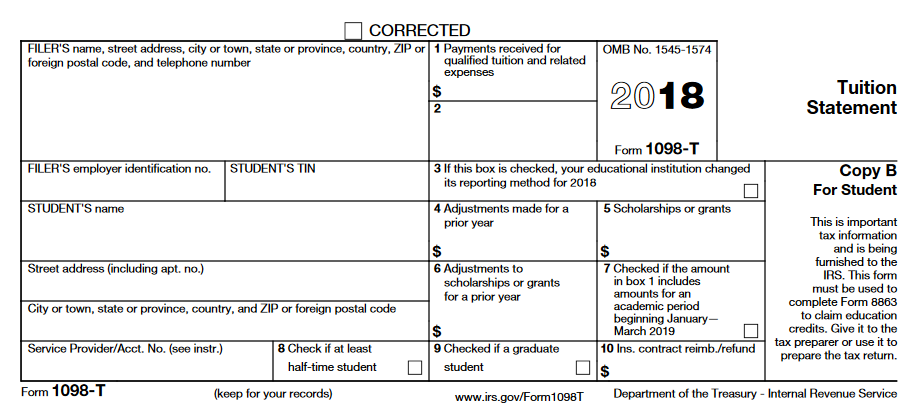

1098-T Tax Form

The Taxpayer Relief Act of 1997 requires that all educational institutions provide U.S. citizens or permanent residents with a tax form detailing payments made for qualifying tuition and related expenses charges for the calendar year. This form is referred to as Form 1098-T.

Educational institutions are not required to provide forms to non-resident aliens, students who do not provide the institution with a Social Security Number, or when a student is registered only for courses with no academic credit. As a result, you may not receive a form under these circumstances however if you are a non-resident alien or did not provide DMC with a Social Security Number you can request a form and TIN (taxpayer Identification Number).

Form 1098-T is administered by a third-party provider, Heartland ECSI, on behalf of DMC and will be mailed and made available on their website no later than January 31st of each year.

To access your 1098-T form electronically, please log into Banner Self Service and scroll down to the bottom of the page where you will see the TAX NOTIFICATION link.

Below are descriptions of certain information contained in Form 1098-T which will assist you in better understanding the form:

- Box 1: Payments received for qualifying tuition and related expenses. This amount includes payments from all sources and is reduced by any reimbursements and refunds the student received relating to payments of qualified tuition and related expenses. This box will include payments of past-due qualified tuition and related expenses from a previous calendar year if the student was billed for these charges. Payments for the calendar year cannot exceed the qualified tuition and related expenses for the calendar year.

- Box 2: Total amount billed for qualified tuition and related expenses less any reductions in charges. This amount includes tuition, comprehensive fees, and course fees. Non-qualifying expenses are medical insurance fees, fines and miscellaneous charges, and room/board charges. Beginning in 2018, this box will no longer be reported. Box 1 will be reported instead of Box 2

- Box 5: Total amount of any scholarships or grants that were administered and processed during the calendar year for the payment of the student's costs of attendance.

- Box 7: Amounts billed for qualified tuition and related expenses, reported on the current year’s form, but are related to an academic period that begins in January through March of the following year.

- Box 8: If checked, the student was at least a half-time student during any academic period. A half-time student is a student enrolled for at least half the full-time academic workload for the course of study the student is pursuing.

- Box 9: If checked, the student was a graduate student. The student is a graduate student if the student was enrolled in a program or programs leading to a graduate-level degree, graduate-level certificate, or other recognized graduate-level educational credential.

For additional information and instructions on Form 1098-T, please see IRS Publication 970 or https://www.irs.gov/forms-pubs/about-publication-970

Those students who are subject to a withholding (residents of a non-treaty country), will be assessed a non-resident alien tax each semester. The amount assessed is based on the current tax rate (14%) of the scholarship award for that semester.

Downstate cannot provide individual tax advice and shall not be liable for damages of any kind in connection with this information. Accordingly, you should consult your tax advisor about your specific circumstances.