Debt Management

Take Control of Your Credit and Future…

A good education is really an investment. The potential, long-term benefits of higher earnings as well as a lifetime of career

satisfaction are the dividends of your investment. But today's high costs often make

financing your education a complicated endeavor. Student loans make it possible for

the majority of our students to get the education they deserve. But before you apply

for a loan, study all your options carefully, and make sure you have exhausted all

other sources.

A good education is really an investment. The potential, long-term benefits of higher earnings as well as a lifetime of career

satisfaction are the dividends of your investment. But today's high costs often make

financing your education a complicated endeavor. Student loans make it possible for

the majority of our students to get the education they deserve. But before you apply

for a loan, study all your options carefully, and make sure you have exhausted all

other sources.

Before you borrow any money, remember that your loans will affect your credit far into the future. Whenever you obtain a loan, information regarding that loan is reported to credit bureaus. What you borrow today may determine your ability to borrow in the future for a car, house, or other purchases after you graduate. The amount of outstanding loans will be considered when you apply for any other loans.

We are here for you. If you need assistance with your personal and/or school budget, please email us at financialaid@downstate.edu or click here to schedule an appointment.

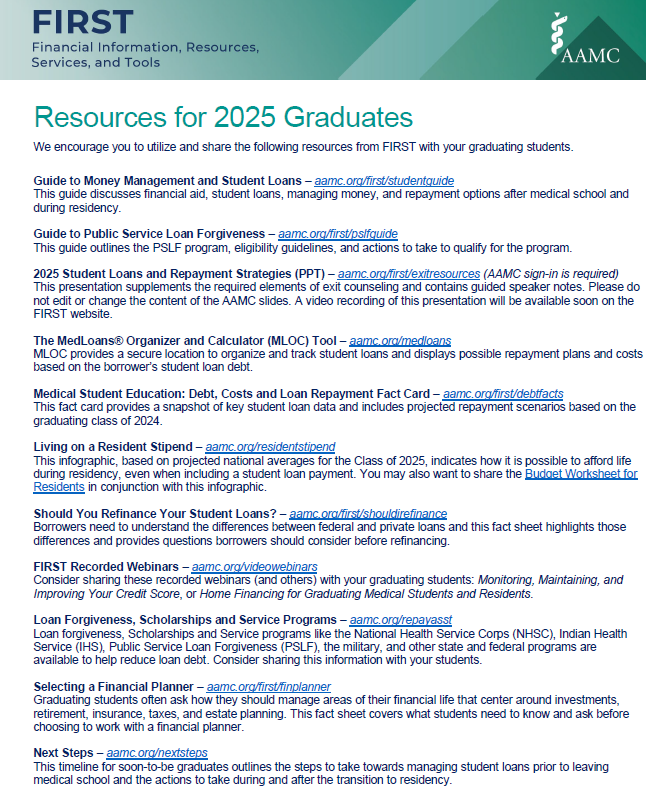

AAMC Financial Resources for 2025 Graduates

This is a list of resources compiled by AAMC including information about repayment strategies, PSLF, refinancing, and financial wellness as a resident.

SUNY Smart Track "CashCourse"

CashCourse is a free, online, noncommercial financial education resource that was designed for enrolled and college bound students "CashCourse"

Because it is important for students to clearly see the bottom line on college costs, we’re committed to transparency regarding the financial commitments of attending our campuses. That is why we created Smart Track®, a collection of resources — including our Net Price Calculator — designed to help students and families understand college costs and develop a financial plan for the future.

Understanding your Debt

- SUNY SMART TRACK

- AAMC Education Debt Manager for Graduating Medical Students (PDF)

- AAMC 7 Ways to Reduce Medical School Debt (PDF)

- Debt-to-Income Calculator

- The Effects of Credit and your Loan History

- Checking Your Credit

- Finding your Federal Loans — National Student Loan Database System

Budgeting

- AAMC Budget Worksheet for Students (PDF)

- AAMC FIRST Financial Aid fact sheets

- AAMC 3 Ways to Minimize the Repayment Cost of Student Loans

- 10 Tips for Managing Your Money During Medical School (PDF)

- AAMC Living on a Resident Stipend of $55,700 (PDF)

- AAMC Budgeting Worksheet for Residents (PDF) — fillable

- 10 Tips for Managing Your Money During Residency (PDF)

Student Loan Links

- National Student Loan Data System - for students to retrieve their federal loan information

- HLFS Loans (Undergraduates)

- Exit Interviews for Students

AAMC Repayment Webinar Documents

- Financial Wellness Card (PDF)

- MLOC Postcard (PDF)

- Next Steps Brochure (PDF)

- Nine Tips on Managing Money During Residency (PDF)

Repaying your Student Loan

- AAMC's "You've Matched! Now What? Preparing Financially and Professionally for Residency" video

- AAMC Loan Repayment Timeline (PDF)

- Understanding Federal Direct Loan Repayment Plans

- AAMC Compare Repayment Plan Options (PDF)

- Loan Repayment Estimator

Consolidation and Refinancing Your Student Loans

- Should You Consolidate your Federal Student Loans? (PDF)

- Should I Refinance My Federal Student Loans?